When new medical spas open, they often lean heavily on injectables. Toxins have a reliable pull: patients understand them, demand is high, and they provide a strong entry point for growing practices. But as the market matures, relying too much on injectables exposes businesses to margin pressure, staffing constraints, and shifting consumer preferences.

A truly healthy medical aesthetics business requires a more balanced service mix; one that includes injectables, energy-based devices (EBDs), medical-grade skincare, and emerging categories such as weight loss. Getting there is not as simple as adding a new device or chasing the latest trend. It requires a strategic approach to capacity planning, marketing, training, and financial discipline.

At Skytale Group, we see service mix as a lever for both profitability and patient outcomes. Below, two case studies illustrate how rethinking this balance can transform a business.

Understanding Service Mix as a Strategy

A strong service mix strategy is not just about offering more. It is about offering the right combination of treatments that both support patient goals and improve overall profitability. By taking a comprehensive look at patient demographics and understanding what different segments of your patient base are looking for, practices can better align services with demand. This analysis makes it easier to determine which offerings should be expanded, which need repositioning, and how to introduce new categories that complement existing treatments.

Because injectables alone cannot address underlying skin quality, patients achieve the best outcomes when injectables are paired with treatments that address skin health at a deeper level. While injectables remain in high demand, their cost of goods is significant, making energy-based services and body treatments attractive for their higher margins and lower consumable costs. By combining injectables with lasers, body contouring, and medical-grade skincare, practices can deliver both prevention and correction.

New service lines require the right providers who are certified or trained to perform the treatment. When those providers are not already in place, practices must be willing to hire new talent or invest in training to build the necessary expertise within their team. Just as critical, employees at every level need to be able to speak confidently about new offerings, creating opportunities to position them alongside core treatments and encourage patients to explore complementary services. This ability to “sell across the aisle” is often the difference between a device that sits idle and one that becomes a profit center.

Ultimately, a balanced mix also provides future-proofing. With HA filler demand showing signs of decline, categories such as medical weight loss are emerging as important growth drivers that can sustain practices over the long term.

Case Study 1: Reviving Energy-Based Services with Smart Investment

The Challenge

By the end of 2023, one practice saw its energy-based service revenue decline sharply—from about $10,000/month to just $3,000/month. Devices were underutilized, staff enthusiasm had waned, and patients were defaulting almost exclusively to injectables.

The Solution

After a service mix analysis, the practice invested in a new laser platform and repositioned energy-based services within its broader treatment offering. Marketing campaigns highlighted the benefits of pairing skin health treatments with injectables, and staff training reinforced provider confidence in recommending these procedures. As a result, energy-based revenue rebounded to nearly $20,000/month on average in 2024, growing from 5% to roughly 25% of total production.

Why It Worked

This turnaround demonstrates the importance of balancing injectables with higher-margin treatments that address skin health more comprehensively. By reintroducing energy-based services as part of a holistic patient plan, the practice not only boosted profitability but also positioned itself as a full-spectrum aesthetics provider. Patients benefited from more complete outcomes, and the practice reduced its dependency on a single revenue stream.

Case Study 2: Scaling Injectables Through Team Growth

The Challenge

In Q1 2023, injectables represented 46% of total revenue for another practice. By Q4, that number had slipped to 42%. The issue wasn’t patient demand. It was provider capacity. Limited injector availability meant longer wait times and missed opportunities for revenue capture.

The Solution

Following an assessment of staffing and capacity, the practice expanded its provider team by hiring additional injectors. With more availability, scheduling bottlenecks eased, and patient demand could be met more consistently. By Q1 2024, injectables surged to 53% of the service mix, reinforcing the practice’s core revenue stream while creating a healthier balance across services.

Why This Works

Injectables remain the cornerstone of most medical spas, but sustaining growth requires aligning provider capacity with patient demand. By expanding its team, the practice removed scheduling barriers that had been suppressing revenue. More importantly, it created space to meet patient expectations without compromising experience or outcomes. The result was not only stronger revenue from injectables, but also a healthier balance that freed the practice to promote complementary service lines. In this way, staffing becomes a strategic lever within the broader service mix, ensuring practices can capture demand today while positioning for diversification tomorrow.

The Bigger Picture: Defining a Healthy Service Mix

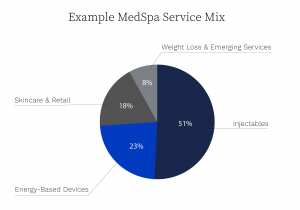

Profitability in medical aesthetics is as much about balance as it is about volume. While the exact ratio will vary by practice, a healthy service mix often includes roughly half of revenue from injectables, with the remainder diversified across energy-based devices, skincare, retail, and emerging categories such as medical weight loss. A model benchmark might look like:

- 50% injectables

- 20–25% energy-based devices

- 15–20% skincare and retail

- 5–10% weight loss and new service lines

This balance delivers benefits on multiple fronts. Energy-based services and body treatments typically yield higher margins than injectables because consumable costs are lower, creating immediate impact on profitability. Patient outcomes also improve when injectables are combined with treatments that address underlying skin quality or provide correction and prevention at deeper levels. Just as important, provider engagement rises when teams are trained, confident, and enthusiastic about new service lines, translating into greater utilization and revenue capture. Finally, diversification provides resilience. As demand for fillers shows signs of softening, services such as medical weight loss are emerging as critical patient acquisition tools and long-term growth drivers.

Final Thoughts

The medspas achieving durable success today aren’t just good at injectables—they’re thoughtful about balance. They recognize that profitability, patient outcomes, and long-term value creation come from a service mix that is both diversified and strategically managed.

Whether it’s reviving underutilized devices or expanding injector capacity, the practices that thrive are those that treat service mix as a strategic lever, not an afterthought. For medical spa owners, the question is no longer if to diversify, but how.